How is Millennial's Investment choice compared to Motley Fool Stock Advisor

(Photo by Sabine Peters on Unsplash)

Robinhood is a popular trading broker whose users base is mainly millennials due to its revolutionary 0 commission offering. The Motley Fool is a financial service which provides financial information on the internet. The Motley Fool offers weekly stock recommendation to the subscribed users. It claims the stocks picked by their experts Tom and David substantially outperform the market.

In this post, I will compare the performance of the Fools’ portfolio (stocks picked recently) and Millennials’ portfolio (popular stocks revealed by Robinhood).

Side by side

Fools’ picks: The Trade Desk (TTD), Appian (APPN), Zscale (ZS), Twilio (TWLO), Zoom Video Communications (ZM), Waste Management (WM), Starbucks (SBUX), Masimo (MASI), Amazon (AMZN), Zynga (ZNGA) and SolarEdge Technologies (SEDG).

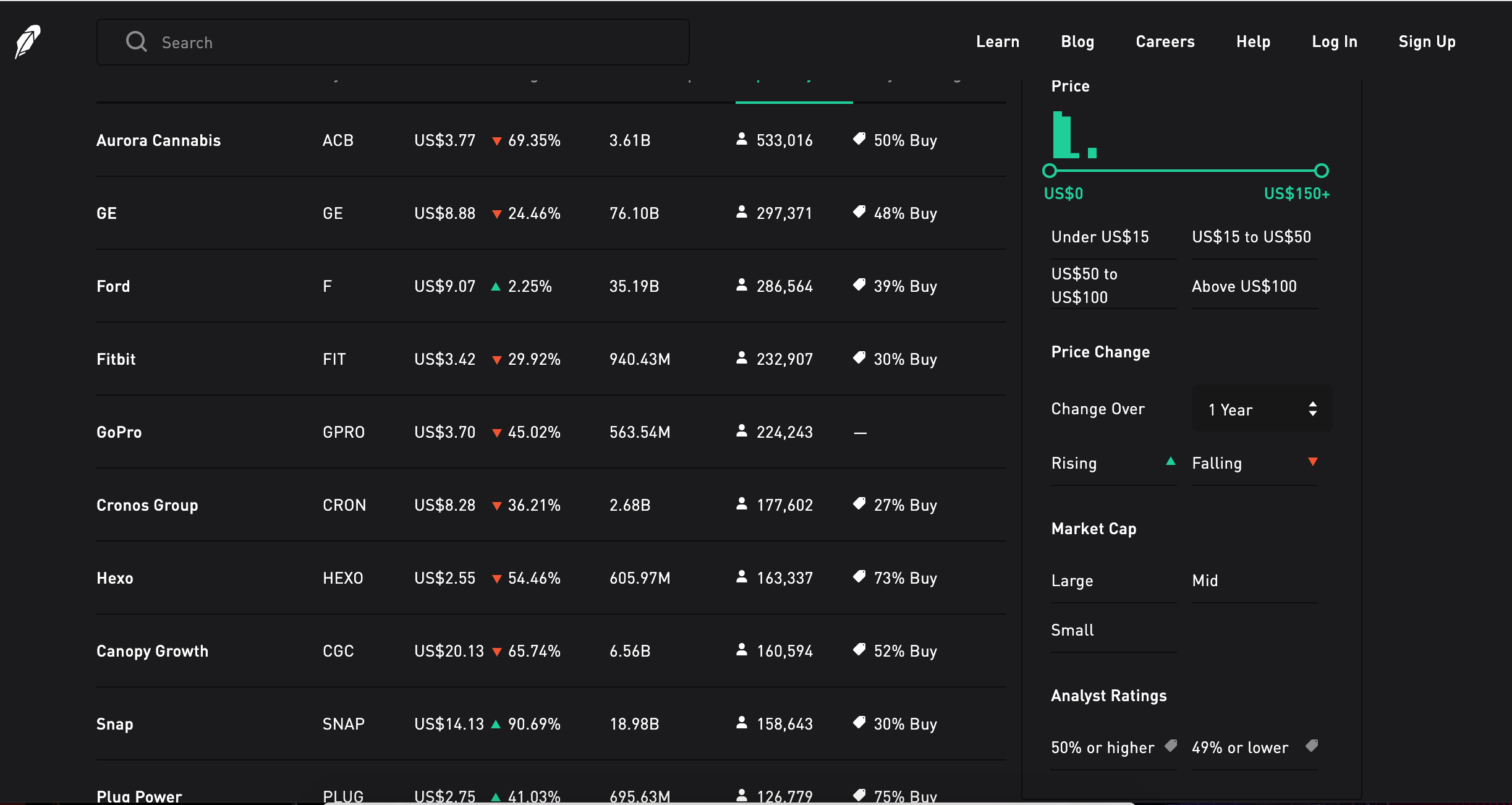

The Millennials picks (top 10 from this list): Aurora Cannabis (ACB), GE (GE), Ford (F), Fitbit (FIT), GoPro (GPRO), Cronos Group (CRON), Hexo (HEXO), Canopy Growth (CGC), Snap (SNAP), Plug Power (PLUG) and Zynga (ZNGA).

With closer look, we can find that the Fools’ portfolio seems to be more diversed than the other. It contains tech, consumers and high dividend stocks. While the Robinhood users focus mainly on tech and marijuana stocks.

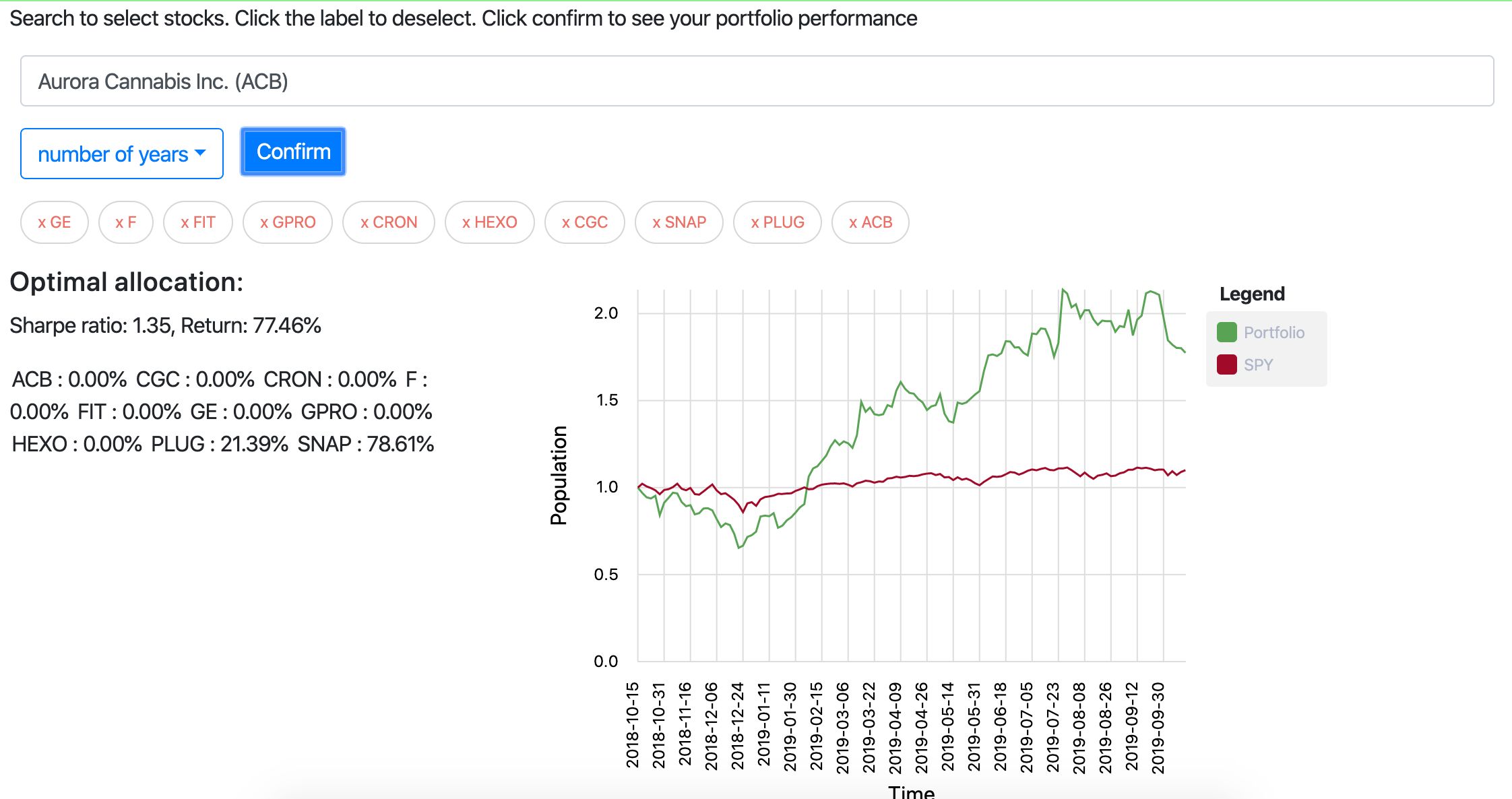

The tool I use to compare the strategy is StockOptimizr. StockOptimizr can compute the best allocation for a given list of stocks based on historical data (1 year, 2 years or 4 years). The indicator of how good a portfolio is is the sharpe ratio. Sharpe ratio measures the ratio of return/risk. A high sharpe ratio means that the portfolio yields relative good performance with relative low risk. In this comparison, I only focus on historical data of 1 year. Following is the performance of Fools’ portfolio. It highlights that among 10 stocks, only a few are contained in the optimal allocation. These are Appian (7.97%), Startbucks (38.41%), SolarEdge(13.56%), Waste Management (39.66%) and Zynga (0.39%). The overall return in this year is 59.24% with sharpe ratio 2.75. This is quite good compared to the market (SPY) which only gains about 9%.

Now, let’s take a look at how Millennials are doing. As below, we found even fewer stocks are used to make an optimal portfolio. Only Plug Power (21.39%) and Snap (78.61%) are in the optimal portfolio. That may be because those marijuanas stocks were too volatile in the past year. This portfolio has substantial higher return 77.46% compared to the Fool’s portfolio 59.24%. However, it’s worth mentioning that the sharpe ratio is much lower, only 1.35. It’s high return is at the cost of bearing more risks. That can also reflect that our young generation is willing to take risk for high potential gain.

Though numbers are quantified, it is hard to tell which portfolio is better than the other. It has to be measured by your own need. Generally speaking, young generation have the time to take the risk for high return. Older generation may tend to buy safer high dividend stock. But a couple important rules that should apply to all are diversification and save enough money to invest for long term.